Paul B Insurance Medigap Fundamentals Explained

Wiki Article

Some Known Factual Statements About Paul B Insurance Medigap

Table of ContentsAll about Paul B Insurance MedigapThe 30-Second Trick For Paul B Insurance MedigapTop Guidelines Of Paul B Insurance MedigapThe Buzz on Paul B Insurance Medigap3 Simple Techniques For Paul B Insurance Medigap

Eye health and wellness becomes extra vital as we age. Eye exams, glasses, and also calls are a part of numerous Medicare Advantage strategies. Initial Medicare does not cover hearing aids, which can be costly. Many Medicare Advantage prepares provide hearing coverage that includes testing as well as clinically needed listening devices. Medicare Advantage intends provide you options for keeping a healthy lifestyle.Insurance policy that is bought by an individual for single-person insurance coverage or protection of a family. The specific pays the premium, instead of employer-based medical insurance where the employer frequently pays a share of the premium. Individuals might purchase as well as purchase insurance coverage from any type of strategies available in the person's geographical area.

Individuals and also families may certify for financial assistance to decrease the expense of insurance coverage costs and also out-of-pocket expenses, yet only when registering with Link for Health Colorado. If you experience specific modifications in your life,, you are eligible for a 60-day period of time where you can enroll in an individual plan, even if it is outside of the yearly open enrollment period of Nov.

Some Known Incorrect Statements About Paul B Insurance Medigap

15.Any individual age 65 or older qualifies for Medicare, which is a federal program that supplies cost effective medical care coverage. There are some considerable differences in between Medicare and also exclusive insurance coverage plan alternatives, coverage, costs, and more.

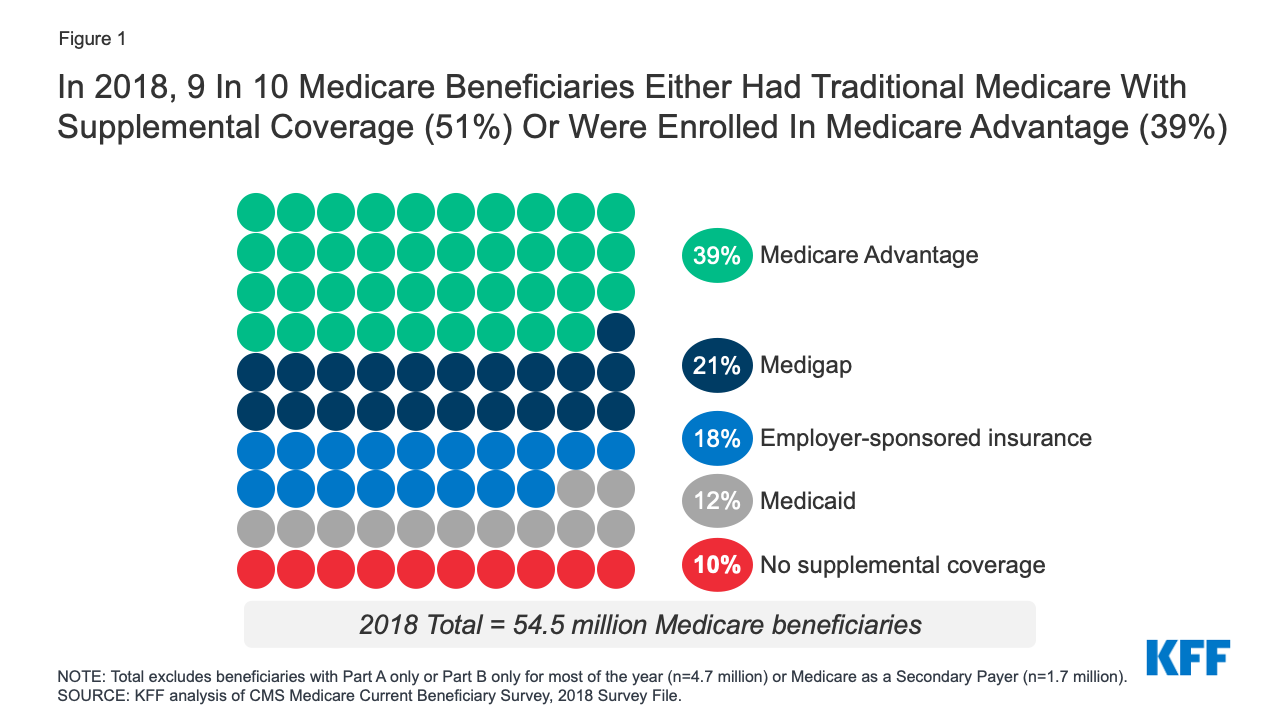

Medicare Benefit (Part C), Part D, as well as Medigap are all optional Medicare plans that are sold by personal insurer. Medicare Benefit strategies are a popular choice for Medicare beneficiaries since they provide all-in-one Medicare protection - paul b insurance medigap. This consists of initial Medicare, as well as many plans likewise cover prescription drugs, dental, vision, listening to, as well as various other health advantages.

The differences in between Medicare and also exclusive insurance coverage are a significant variable in determining what kind of strategy might function best for you. When you sign up in Medicare, there are 2 primary parts that make up your protection: There are many options for acquiring private insurance. Many individuals acquisition private insurance policy via their employer, and also their employer pays a section of the premiums for this insurance coverage as a benefit.

The 10-Second Trick For Paul B Insurance Medigap

There are 4 tiers of personal insurance policy plans within the insurance coverage exchange markets. Bronze strategies have the greatest insurance deductible of all the strategies but the cheapest regular monthly costs.

Gold strategies have a much reduced deductible than bronze or silver strategies but with a high regular monthly premium. Platinum plans have the lowest insurance deductible, so your insurance policy typically pays out really quickly, however they have the greatest regular monthly costs.

In addition, some private insurance coverage business also offer Medicare in the kinds of Medicare Advantage, Part D, as well as Medigap plans. The protection you obtain when you authorize up for Medicare depends on what kind of strategy you pick.

If you need additional protection under your plan, you have to select one that provides all-in-one coverage or add extra insurance coverage plans. You might have a plan that covers your healthcare solutions however requires extra plans for oral, vision, and life insurance benefits. Nearly all health and wellness insurance policy plans, private explanation or otherwise, have expenses such a costs, insurance deductible, copayments, as well as coinsurance.

Getting My Paul B Insurance Medigap To Work

There are a selection of costs connected with Medicare coverage, depending on what kind of plan you pick. Right here is an appearance at the expenses you'll see with Medicare in 2021: Many individuals are eligible for premium-free Part A coverage. If you haven't functioned a total of 40 quarters (one decade) during your life, the regular monthly costs ranges from $259 to $471.The day-to-day coinsurance expenses for inpatient care array from $185. 50 to $742. The monthly costs for Component B starts at $148. 50, as well as can be more based upon your income. The insurance deductible is $203 for the year. Coinsurance is 20 percent of the Medicare-approved expense for services after the insurance deductible has actually been paid.

These amounts vary based on the plan you pick. In enhancement to paying for components An and B, Part D costs differ depending on what kind of medication insurance coverage you require, which medications you're taking, and what your premium and insurance deductible amounts consist of. The regular monthly and also yearly price for Medigap will depend upon what type of strategy you pick.

One of the most a Medicare Advantage strategy can butt in out-of-pocket prices is $7,550 in 2021. paul b insurance medigap. Initial Medicare (components An and B) does not have an out-of-pocket max, indicating that your medical costs can promptly include up. Below is a summary of some of the typical insurance coverage expenses as well as just how they collaborate with regard to personal insurance you can try here coverage: A costs is the month-to-month cost of your medical insurance strategy.

Paul B Insurance Medigap - Truths

Coinsurance is a portion of the total approved expense of a solution that you are responsible for paying after you've satisfied your insurance deductible. Every one of these prices depend on the type of personal insurance policy strategy you pick. Take stock browse around these guys of your financial circumstance to identify what kind of month-to-month and also annual payments you can afford.

Report this wiki page